Selling Now to Cash in Your Chips -or- Let it Ride?

If you cash in your chips and sell your home now, of course you need a place to go. If you have that part worked out, and you are looking to relocate, maybe downsize, maybe rent for a while, whatever the reason for selling… your timing might be perfect to cash in your “equity” chips.

As I see it, here is the case for selling now…

FACT 1 : Interest rates are still low!

Translation: Home Buyer’s can afford to borrow the money! As I write this, interest rates are still low enough to keep home buyers in the marketplace. BUT… This might be changing soon.

Freddie Mac warns that rates could move higher if signs of inflation persists. From Freddie Mac’s PMMS Report:

“Mortgage rates have been holding steady over the past two months. The U.S. weekly average 30-year fixed mortgage rate was 4.42 percent in this week’s survey. Rates have bounced around 4.4 percent since mid-February. Rates could break out and head higher if inflation continues to firm.” The Freddie Mac Report went on to say… “If inflation continues to trend higher, we may see two or three more rate hikes from the Fed this year, and mortgage rates could follow. For now, mortgage rates are still quite low by historical standards, helping to support homebuyer affordability as the spring homebuying season ramps up.”

FACT 2: Housing inventory is low!

Housing inventory in both Broward and Palm Beach County are still in short supply. Translation: it’s still a Seller’s Market!

Any Realtor can tell you there is still an inventory shortage. Brian Bandell of the South Florida Business Journal recently summarized the current housing statistics in Broward and Palm Beach County this way: “Single-family home sales in the tri-county area declined 7.6 percent to 4,111, compared to March 2017”. He also said “South Florida’s condo/townhome market saw sales plummet 10.1 percent to 3,914”.

If you broke this down even further, you’d find the biggest inventory squeeze in the $250,000. to say $450,000. price range for single family homes. There is more inventory (especially with competition from new construction), in the $450,000. to a $1,000,000 plus range.

FACT 3: Home values are up, up up!

Property values in Gotham are up, and they have also gone up in Coconut Creek, Coral Springs, Parkland, and Boca Raton. They are up from Wellington down to Pembroke Pines, from Plantation over to Deerfield Beach, and all over Broward and Palm Beach county. As Batman said, prices have risen as much as 9% over the last 12 months along. Batman, is there no end in site?

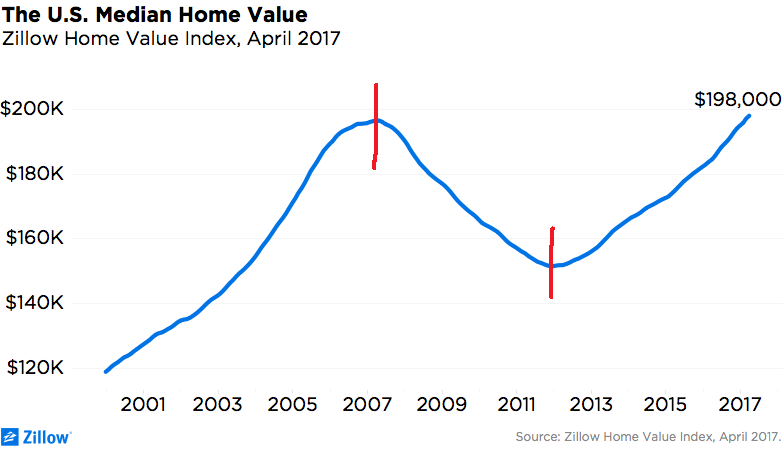

Unfortunately for property owners, we all know that real estate values don’t always go up in a straight line.

The Bottom Line

If you are purchasing a home and plan on dropping your anchor and staying put for at least five, better yet say seven years, it’s usually hard to lose with real estate. Of course, there have been exceptions.

Some people who purchased a home at the very top of the market (say 2005-2006), are only now getting close to breaking even. Some say that was more like an anomaly, with banks and lenders really misbehaving (misbehaving is putting it kindly). At that time, lending institutions were giving out loans like you would give out candy to children on Halloween. They were approving people who should have never been qualified. Remember the “low-doc” and “no-doc loans“? All you really needed was a heart-beat to secure a mortgage.

There were crazy loan programs that also featured “negative amortization“.

“Don’t worry Mr. & Mrs. Borrower, we’ll just make that monthly payment smaller for the first 5 or 7 years so you can qualify. We’ll just add the shortfall to your loan balance, and you can just refinance later down the road”. In other words, it was like selling someone a ticking time bomb! There were all kinds of crazy iterations being pitched to consumers. \

Needless to say it all blew up and the housing market went into free fall. It was not a pretty, especially considering how far the market plunged (see the Zillow chart at the top of this page). It was extremely devastating here in Broward and Palm Beach. As a full-service discount real estate company between 2007 to 2014, most of our time was spent helping our Sellers with short sales. The fact that we can save home sellers substantial amounts of equity in commission savings didn’t even matter. With a short-sale, the homeowner is upside down so there is no equity to save.

Well that was then and this is now.

Actual Listing Photo by Tom Carroll – Assist 2 Sell – Parkland FL

I do believe it’s much harder to predict just how property values will change over a 12 to 24 month period. Its also impossible to pick the very top (or bottom) of a real estate cycle.

As this Zillow chart illustrates, if you are working with a 7 year time frame (in terms of staying put), I wouldn’t be so worried about where property values will be when the time comes to sell. Time is on your side. On the other hand, if you are thinking about selling sometime in the next 12 to maybe 24 months, this might be a really great time to move the process forward a little.

As this Zillow chart illustrates, if you are working with a 7 year time frame (in terms of staying put), I wouldn’t be so worried about where property values will be when the time comes to sell. Time is on your side. On the other hand, if you are thinking about selling sometime in the next 12 to maybe 24 months, this might be a really great time to move the process forward a little.

Some “so-called” experts are saying that home prices have started to level off.

“Within the last few months, there are beginning to be some signs that gains in housing may be leveling off,” said David Blitzer, S&P Dow Jones Indices managing director and chairman of the index committee. “Sales of existing homes fell in December and January after seasonal adjustment and are now as low as any month in 2017. Pending sales of existing homes are roughly flat over the last several months.”

Will home prices now start to level off or even go down a little as interest rates tick up? Will home values continue to rise, but at a much slower pace? What do you think? One thing we do know looking back, home prices have risen dramatically over the last few years starting around 2013. So depending on your circumstances, this could be a great time to sell and cash in your equity?

As my Mom use to say, “only time will tell”.

Me and Mom

Tom Carroll, PA, REALTOR, CRS, ABR,

Assist 2 Sell Co-Owner.